[ad_1]

In at the moment’s financial system, with costs surging on all the pieces from groceries to fuel, we’re all feeling the strain on our wallets. Discovering methods to trim our on a regular basis bills is now not only a good choice—it’s a necessity. For these like me, combing via payments and subscriptions in hopes of figuring out financial savings alternatives is time-consuming and, let’s face it, not essentially the most enjoyable job. Luckily, there’s a service that does all of this for you, providing a hands-off resolution to decreasing your payments: Windfalls.

This AI-driven invoice discount service has been a current discovery for me, and thus far, it’s proving to be a recreation changer. Windfalls guarantees to investigate your payments, determine potential financial savings, and negotiate with service suppliers to chop your prices. One of the best half? It’s virtually fully automated. I’ve been utilizing Windfalls for simply over every week now, and I’m excited to share my experiences with this new tech device. With out additional ado, right here is my Windfalls AI app overview.

Ease of Use

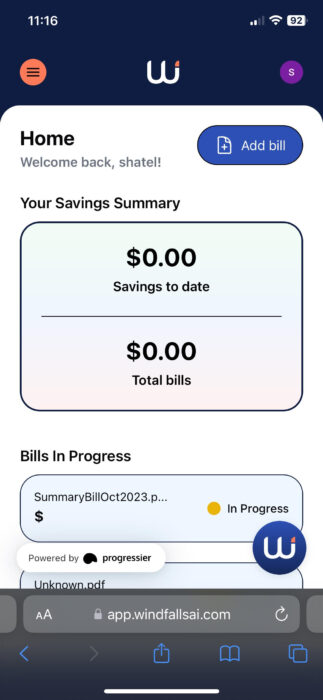

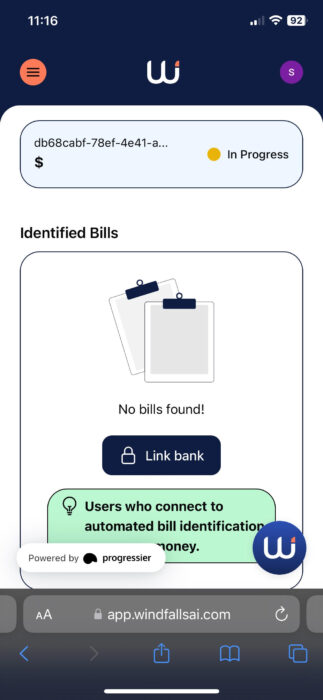

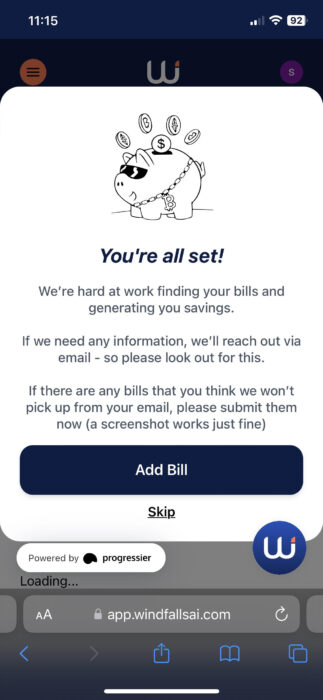

One of many first issues I seen about Windfalls was how intuitive and user-friendly the web site is. Inside minutes of touchdown on their homepage, I used to be capable of create an account and begin the method of getting into my payments. Windfalls provides two methods to get began: you’ll be able to both manually add your payments, or you’ll be able to hyperlink your checking account, permitting the AI to scan your transactions and pull out recurring funds mechanically.

Personally, I had some bother linking my checking account after I first tried utilizing my telephone—the connection merely wouldn’t undergo. Nonetheless, I switched to my pc and was capable of hyperlink my account, although it didn’t add my transaction historical past. This was a little bit of a hiccup, nevertheless it didn’t cease me from persevering with with the method. I manually uploaded 5 payments as a substitute, which solely took a couple of minutes every. The platform is obvious and easy, although some payments (like web and telephone) require further particulars, corresponding to account passcodes or particular supplier data.

General, the method of getting began with Windfalls was pretty easy, and took me round 20 minutes to arrange my account, add the required paperwork, and sit again whereas the AI started its work.

Cash Again With out Upfront Charges

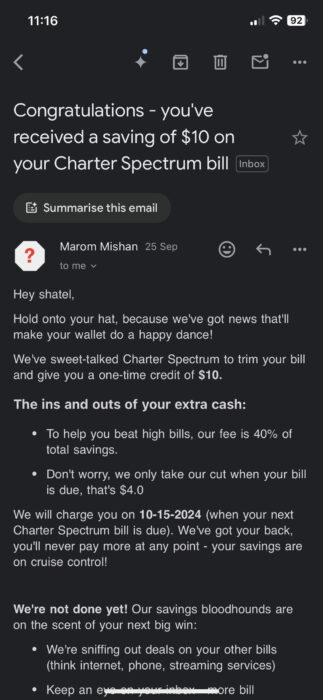

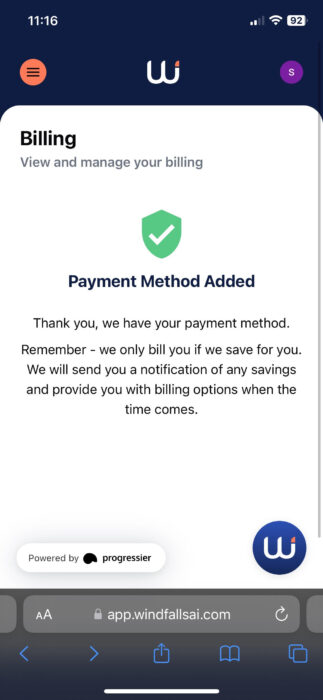

One of many most attractive features of Windfalls is its pricing mannequin. The service operates on a “no financial savings, no charge” foundation, which suggests you don’t pay something except they prevent cash. There’s no upfront value or hidden charges—if the AI finds a technique to scale back your payments, you retain 60% of the financial savings, they usually take 40%. Whereas this may increasingly sound like a big minimize, it’s a good commerce when you think about the comfort and experience that Windfalls brings to the desk.

In only a week of utilizing Windfalls, I used to be already seeing outcomes. The service managed to get me a one-time $90 credit score on my T-Cell phone invoice and a $10 credit score on my web invoice. Not unhealthy for only a few minutes of setup! I additionally uploaded two hospital payments and an electrical invoice, that are nonetheless being reviewed, however I’m optimistic in regards to the potential savings.

What’s nice about this service is the peace of thoughts it provides. Understanding that you simply solely pay if Windfalls delivers financial savings takes away the monetary threat, making it a straightforward alternative for anybody seeking to minimize prices.

Know-how and Safety: Plaid Makes It Protected

Relating to dealing with your funds on-line, safety is a high concern. Windfalls makes use of Plaid expertise to attach your financial institution and bank card accounts, which is reassuring as a result of Plaid is broadly thought to be a trusted and safe system. Many high monetary apps use Plaid, so it’s good to see Windfalls incorporating this expertise into their platform.

By linking your checking account, the AI can rapidly analyze your recurring funds and negotiate with firms in your behalf to get you higher offers. Windfalls additionally permits you to hyperlink your e-mail account, which supplies the AI entry to on-line receipts and fee confirmations, additional streamlining the method of monitoring and reducing your bills.

I appreciated the extent of safety and encryption that Plaid gives, particularly because it’s one thing I’m aware of from different monetary companies I take advantage of. Whereas my preliminary try and hyperlink my financial institution didn’t work, this was seemingly a minor technical challenge, as Plaid is mostly dependable.

Outcomes: Actual Financial savings in Report Time

The core purpose to use Windfalls is to save money, and from what I’ve skilled thus far, the service delivers. Inside only a week of signing up, I noticed over $100 in credit utilized to my accounts. The method is ongoing, so I’m desperate to see what different financial savings Windfalls will negotiate for me over time.

What makes Windfalls stand out is how hands-off the method is. The AI does all of the heavy lifting—from figuring out financial savings alternatives to speaking with service suppliers. Nonetheless, there’s a little bit of a draw back to this. At the moment, as soon as a invoice is uploaded and marked as “in progress,” there isn’t a lot transparency on what’s occurring behind the scenes. You don’t get updates or insights into how negotiations are going, which may go away you feeling a bit in the dead of night. Extra detailed standing updates or notifications would go a good distance in enhancing the person expertise.

Execs and Cons of Windfalls

Like all service, Windfalls has its professionals and cons. Right here’s a breakdown based mostly on my expertise:

Execs:

- No upfront charges: You solely pay if Windfalls saves you cash, which makes it risk-free.

- Ease of use: The web site is user-friendly, and importing payments or linking accounts takes simply minutes.

- Automated financial savings: The AI handles the negotiation course of, saving you effort and time.

- Actual outcomes: I saved over $100 within the first week with Windfalls, and the potential for future financial savings is thrilling.

Cons:

- Financial institution connection points: I had bother linking my checking account on my telephone, and even after efficiently linking it on my pc, transaction knowledge didn’t add.

- Transparency: The service doesn’t present a lot perception into ongoing negotiations or the standing of payments in progress.

- Restricted management: Whereas the hands-off method is handy, it additionally means you’ve got little say in how your payments are negotiated.

Windfalls AI App Assessment: Is It Value It?

General, Windfalls provides an modern and handy technique to decrease your payments with out a lot effort in your half. The platform is simple to make use of, the financial savings are actual, and the truth that you solely pay in the event that they prevent cash is a big plus. Whereas there are some minor glitches and areas the place transparency may enhance, Windfalls is a service that has loads of potential.

For those who’re like me and also you dread the considered spending hours negotiating with service suppliers or searching down reductions, Windfalls can be a game-changer. The financial savings I’ve seen thus far are encouraging, and I’m trying ahead to seeing what extra this service can do within the coming months.

Take a look at Windfalls AI for your self by signing up here.

[ad_2]

Source link