[ad_1]

Let’s say that you’re holding shares in a blue-chip firm. The inventory has completed effectively in the previous couple of years. However, you want a technique to generate extra earnings. You possibly can all the time promote your shares, however you suppose the inventory will proceed to extend in worth. So that you need to maintain onto the shares. How do you earn a living from the inventory with out promoting your shares?

Right here is how one can unlock the hidden potential.

Dividends: The Energy of Compounded Reinvestment

If the inventory you’re holding pays dividends, you may merely do nothing. Simply sit again and reinvest the funds. This tried-and-true methodology permits you to reinvest your earnings again into the very shares that generated it. You get the advantage of your portfolio rising exponentially. This works effectively.

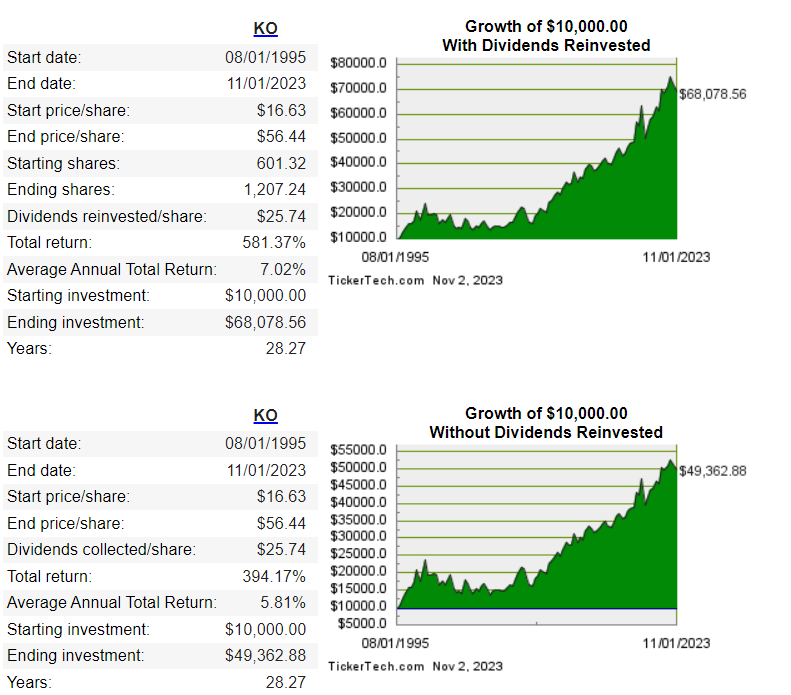

Listed below are a few comparative charts. They present the expansion of the Coca-Cola firm during the last 28 years. The lengthy and wanting it’s that should you merely let the inventory sit and compound and also you reinvested all of your dividends, you’d have roughly doubled the variety of shares you personal and elevated the worth from 49 thousand to 68 thousand.

Picture courtesy of Dripreturnscalculator.com

So, one technique to earn a living from shares with out promoting them is simply to carry the shares and gather the dividends, or allow them to reinvest.

Lending Your Shares through Brokerage Lending Packages: Passive Revenue on Steroids

One other good technique that lets your shares give you the results you want even if you’re not actively buying and selling is lending your shares.

A lot of the main brokerage corporations, like Schwab or Constancy, have applications that can help you lend your shares. The businesses want the shares to fulfill the demand for brief promoting.

These applications often have particular names. In Schwab’s case, it’s known as the “Fully paid Program”. In Constancy’s case, it’s known as ‘Full paid lending”.

Listed below are some fast factors about these lending applications:

- There’s often an utility course of. It’s important to discuss with an actual particular person.

- Most brokerages have internet price necessities. They need to be certain you must have the funds for to know what you’re doing.

- You usually retain financial management of your shares. You may all the time cancel this system should you’re not pleased.

- The brokerage home will usually pay you curiosity on the loaned shares. Curiosity will differ primarily based on the safety in query. Normally, the curiosity accrues every day and is paid month-to-month.

- Generally, you’ll nonetheless get your dividend funds or money as a substitute of the dividend

It’s like having a tireless monetary assistant that generates income around the clock. So, with this feature, sit again, chill out, and let your shares do the heavy lifting!

Promoting Choices: Strategic Maneuvers for Most Beneficial properties

Third on the record of the way to earn a living out of your shares with out promoting them is buying and selling choices. This superior approach permits you to revenue from market actions with out relinquishing possession.

When individuals speak about choices, they’re referring to monetary devices which are primarily based on the worth of the underlying inventory. They’re contracts that provide patrons the chance to purchase or promote the underlying asset at a particular value. Not like futures contracts, patrons of choices contracts don’t have to purchase or promote the asset in the event that they determine towards it.

Every choices contract could have a particular expiration date – the contract holder should train their choice by this date. The particular value is commonly known as the “strike value”.

Like shares and bonds, choices are often purchased or offered by way of brokerage corporations.

With the precise technique, choices allow you to seize alternatives and increase your earnings potential.

Getting A Mortgage Towards Your Shares – Margin Lending

A fourth choice if you’d like you need to earn a living out of your shares and nonetheless preserve them is getting a margin mortgage.

Mainly, a margin mortgage permits you to borrow out of your brokerage agency utilizing your shares as collateral. Buyers often make use of margin mortgage funds to purchase extra securities, however you can even withdraw the cash or use it for different causes. Once you borrow on margin, you pay curiosity on the mortgage for so long as it’s excellent. Margin loans usually have versatile and negotiable phrases, however it’s worthwhile to preserve a degree of property within the account the place you have got the mortgage at a excessive sufficient degree to cowl the banks threat. And, your dealer supplier can promote the shares at any time.

Margin lending is regulated by the monetary business, by the alternate and the broker-dealer.

Many IRA accounts should not eligible for loans. Normally phrases are higher you probably have extra property within the account.

Last Thought – What If You Don’t Maximize the Worth of Your Shares?

As a remaining thought – contemplate doing a thought train. Ask your self this: what occurs should you don’t maximize the worth of the shares you personal? What would occur should you didn’t reinvest your dividends, lend your inventory or commerce choices? What could be the 1-year final result? The five-year final result? The ten-year final result?

The reply to those questions ought to provide help to see if any of those choices make sense for you.

As all the time – don’t neglect, that no person will care as a lot about your cash as you do.

Disclaimer: Keep in mind, investing includes dangers, and it’s vital to do your analysis or seek the advice of a monetary advisor earlier than making any choices. The methods talked about above might not be appropriate for all traders and may end up in vital monetary losses. All the time proceed with warning and contemplate your circumstances.

Learn Extra:

- 6 Exceptional Investment Newsletters to Supercharge Your Portfolio

- How to Build Wealth: A Step-By-Step Guide Through Real Estate Investments

- Worried About Investing in Crypto? Here Are Tips and Tricks to Keep Yourself Safe and Have Some Peace of Mind

Come again to what you like! Dollardig.com is essentially the most dependable money again website on the internet. Simply enroll, click on, store and get full money again!

[ad_2]

Source link