[ad_1]

It’s an accepted a part of self-help knowledge that it takes twenty-one days to develop a brand new behavior and make it stick. This has been discovered to be true in weight reduction, smoking cessation, decreasing alcohol consumption, and lots of different regimens designed to create optimistic cash habits. It will also be utilized to your funds. If you’re having hassle getting motivated to create a greater monetary life, a devoted effort over simply twenty-one days can create higher cash administration habits.

In fact, it’s not a miracle remedy. For those who’re in deep monetary hassle you definitely gained’t be capable of clear up all of your issues or pay all of your debt in twenty-one days. That’s not the purpose. What you’re attempting to do over these twenty-one days is to put the muse for tackling your cash issues over the longer haul. You employ these twenty-one days to create higher monetary habits so you may get out of hassle and keep away from getting in hassle subsequent time. For those who’re doing nothing about your funds, these twenty-one days can get you began on the fundamentals.

Beneath are twenty-one issues you are able to do to create higher cash administration habits. Each is sufficiently small to be executed in a day. (Relying in your state of affairs it might require a protracted day, however it may be executed in a day.) Do one factor per day (you don’t must do them so as) and you need to be in your strategy to higher cash administration habits. For those who can go for 3 weeks with out falling again into your outdated patterns, you stand a greater likelihood of popping out on the opposite facet with new, ingrained, cash administration habits.

1. Work out precisely how a lot you owe.

This appears like a “duh,” however you possibly can’t make a plan with out understanding precisely how a lot you owe and to whom. It’s time to come back clear. Record all loans, strains of credit score, HELOC’s, bank cards, “X months identical as money” presents, 0% financing, and so on. Record every little thing, irrespective of how small, together with that $10 you owe your coworker for lunch final week. For those who don’t know what you owe, you possibly can’t create a plan to change into wealthier.

Doing that is fairly easy, you simply want a bit of paper, or a computerized spreadsheet. Then you definitely record every little thing you owe, the quantity of the month-to-month funds — and the way costly the debt is (or the rate of interest you’re paying on it). Then take into consideration the way you you need to pay it off.

2. Work out precisely how a lot you could have.

Tally up all of your belongings, together with money, 401(okay)’s, IRA’s, shares/bonds, your change jar, and the cash in your mattress. If doable, embody an approximate worth for your own home, should you personal one. Don’t depend “anticipated” cash like tax refunds or inheritances till you could have them. Anticipated cash just isn’t cash you could have. Many individuals do not know how a lot they’ve (or don’t have). It’s arduous to create any kind of monetary plan with out understanding precisely how a lot you could have.

3. Work out your web value.

Figuring your web value could be very easy. You simply subtract the way you owe from how a lot you could have (your belongings minus liabilities). That is your web value. It’s a helpful quantity to know. If it’s optimistic, you’re performing some issues proper and also you need to hold heading in that course. If it’s adverse, you’ve received issues and must work on them ASAP. It’s not a quantity that issues to anybody however you, however it’s a good indicator of the place you’ve been and the place you’re heading. Its vital to do that frequently. It is because what will get measured, will get improved.

4. Know the way a lot you deliver residence each month.

As stunning as this sounds, many individuals don’t understand how a lot earnings they’ve. Many individuals usually deliver however not how a lot they really deliver residence every month. Work out what you truly deliver residence after taxes, insurance coverage, flex spending, 401(okay) and every other deductions. You can too embody curiosity you earn on financial savings, so long as withdrawing that curiosity gained’t price you penalties. That is the quantity you must work with each month to spend, save, and pay down debt.

5. Get your credit score stories from all three credit score bureaus.

You may get one free per yr from every bureau at AnnualCreditReport.com. Examine for inaccuracies, money owed you’ve forgotten about (should you discover any, regulate your numbers in #’s 1, 2 and three), and anything that doesn’t appear proper. Work out a plan of assault for resolving any errors and cleansing up your report. A clear report makes it simpler to qualify for automobile loans and mortgages, should you want them.

You’ll find the web site for annual credit score report here.

No matter you do, don’t pay to get your credit score report. You may get it without cost at annualcreditreport.com. Your financial institution or credit score union may additionally be capable of give it to you without cost.

6. Determine your spending drains.

Spending cash is a truth of life. Everybody has spending drains. Some folks wish to eat out, some folks accumulate issues, some folks can’t half with their morning espresso. A variety of occasions these spending drains are nearly unconscious.

One good strategy to get a deal with in your spending is to make use of a finances/expense monitoring app. These observe all of your digital transactions, and categorize them. Good apps are Lunch Money (which is new, and nicely designed) and Quickens Simplifi product. Quicken’s product is extra developed, however Lunch Cash is newer and higher tuned into its customers wants.

You’ll find Lunch Cash here, Quicken is here.

7. Don’t spend something for sooner or later.

Go simply sooner or later and spend nothing. Don’t purchase espresso, don’t go to the drive-thru, don’t cease at Goal for “only one factor.” Don’t even purchase gasoline. See how good it feels to go with out spending for a day. Now attempt to add extra no-spend days to your life.

8. Work out your charges.

Pull out your financial institution and bank card statements and appears on the charges you’re being charged for overdrafts, ATM withdrawals, late charges, account upkeep charges, and so on. Work out a strategy to remove these fees-call the financial institution and negotiate, cease doing no matter it’s that’s incurring the charges, or change banks in the event that they gained’t work with you.

9. Manage your invoice paying.

Group just isn’t a bag or shoe field filled with unpaid payments. Create a system in order that when a invoice is available in, it goes right into a holding space till it’s paid. Put your invoice paying provides in a single place to attenuate the aggravation. Then create a system to maintain data of your funds. Get a submitting cupboard or file field to maintain the receipts. If doable, automate as many invoice funds as you possibly can so that you don’t have to fret about it. Possibly it’s worthwhile to make a spreadsheet itemizing all payments and their due dates so you possibly can verify them off as you go. Clear the sheet on the finish of the month and start once more subsequent month.

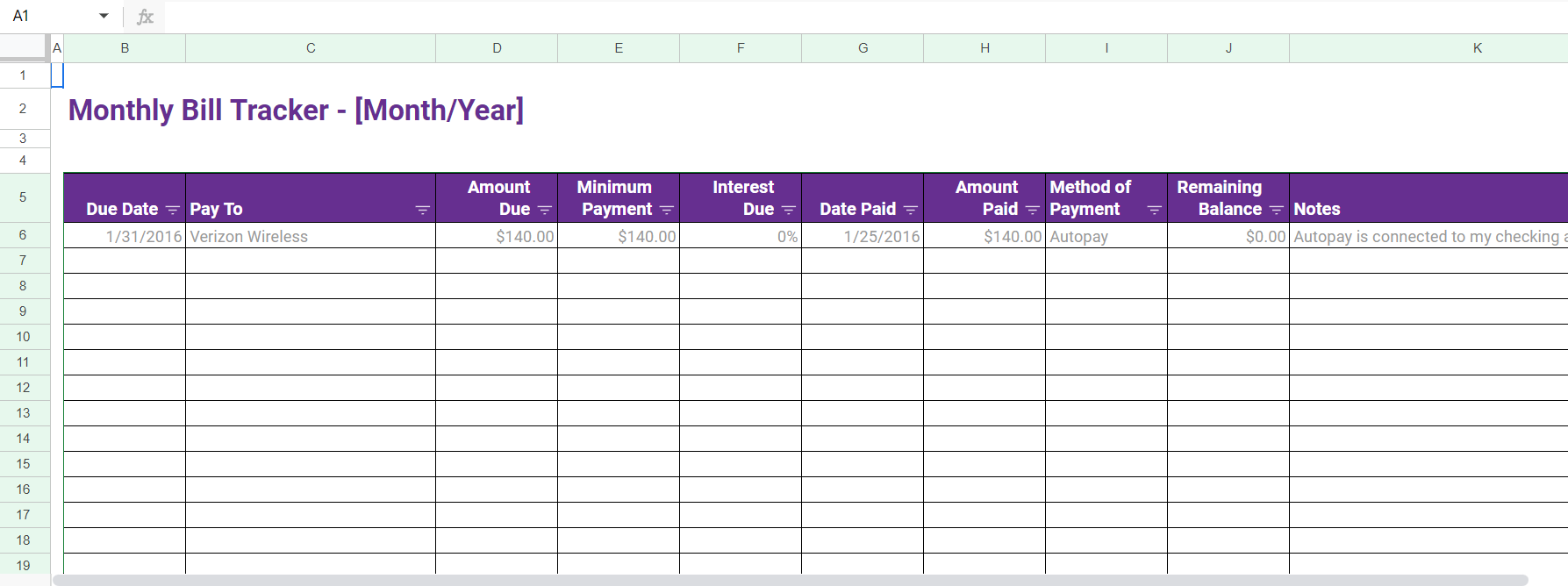

Right here is a good instance of what a invoice tracker appears to be like like:

You’ll find this tracker here.

10. Begin conserving your receipts for purchases.

Many individuals purchase one thing and easily toss the receipt. Retailer them in an envelope, labeled by month. Maintain receipts not less than till the return interval has handed for the merchandise. Increasingly more shops are requiring receipts for returns. Not having the receipt may price you. You additionally need to hold receipts till the purchases have cleared your checking account. Protecting receipts additionally helps you in case it’s worthwhile to observe your bills.

11. Get a shredder and use it.

Shred something with private or monetary info on it to cut back your threat of identification theft. Shredders have actually come down in worth and they’re well worth the peace of thoughts. Proper now Amazon is promoting a great one for beneath $40 bucks, which is basically cheap.

This can be a good instance:

12. Steadiness your checkbook.

Even should you use on-line banking or a cash administration program, reconcile your financial institution assertion along with your checkbook each month. Banks make errors otherwise you would possibly enter one thing incorrectly. Be sure you know that your accounts are right each month. You might also catch bills or earnings you didn’t know you had.

13. Study your insurance coverage insurance policies.

Know what your owners’, well being, life, and automobile insurance coverage insurance policies cowl and the way a lot you’re paying for that protection. For those who suppose you’re underinsured, schedule a chat along with your dealer ASAP to set issues proper. You also needs to make word of when the coverage premiums are due.

14. Examine to be sure you’re not paying greater than you must for insurance coverage.

As soon as you already know what you could have and the way a lot insurance coverage you want, store round to get the perfect worth. What you have already got could also be the perfect fee going, however you gained’t know that till you store round. Put this in your calendar and recheck charges every year.

15. Make a grocery record and buy groceries.

Take the time to learn to stock your pantry and establish your wants. Write all of it down on a listing after which buy groceries. Purchase solely what’s on the record and keep away from off-list temptations. Take into account additionally stepping into coupons or signing up in your grocery retailer’s rewards program. Mindfully planning your grocery spending ought to assist enhance your total diet in addition to hold your grocery prices capped.

16. Begin monitoring your spending.

Get a pocket book, or a spreadsheet and write down each penny you spend in the present day. This offers you an thought of the place your cash goes. Maintain including to this journal day by day. On the finish of a month, you’ll have a transparent thought of what spending areas it’s worthwhile to tackle. Getting apps like Lunch Cash (talked about earlier) or Quicken’s Simplifi are useful for this as nicely.

17. Create a finances.

As soon as you already know what you could have coming in and going out each month, you possibly can sit down and create a finances to raised handle that circulation. It doesn’t must be set in stone, nevertheless it does have to be sensible sufficient to present you a information to comply with as you’re employed via your monetary points. There are actually tons of of articles on the best way to create a finances obtainable on the internet, however a quite simple and fundamental overview from the Federal Commerce Fee is here.

18. Learn one thing about finance.

Training is a strong device in relation to your funds. Right now learn one article or a part of a guide a few monetary matter that pursuits you. Possibly you need to know extra about investing or debt compensation technique. Discover one thing related to you and be taught one thing new. Do that once more one other day and continue to learn. By no means cease.

19. Begin contributing to your retirement.

Merchandise 19 on the record of optimistic cash habits is to begin contributing to your retirement. Use your finances and your newfound information about what you earn to determine an quantity you possibly can put aside for retirement. Whether or not it’s in an IRA, a 401(okay) or a SEP, it’s worthwhile to be contributing one thing to retirement. Begin with no matter you possibly can afford and enhance it regularly. Don’t depend on the federal government to maintain you in your outdated age. Many of the main brokerages like Schwab or Constancy will assist you open an retirement account and might get you began for simply $5 or $10.

20. Begin saving cash for emergencies, automobiles, holidays, and so on.

Open a financial savings account (or add to your current one) and put one thing in there each month or pay interval. Even a bit bit is healthier than nothing. The extra you could have saved, the higher ready you’ll be to climate down occasions or pay money for stuff you want. Improve the quantity you save as you’re able. Many individuals discover cash challenges just like the 365 day money challenge or the 52 week money challenge a good way to begin saving small amount of cash a day.

Click on right here for a pleasant record of money challenges to try.

21. Care for others.

Make sure your family members are taken care of if one thing ought to occur to you. Be sure you have a will and a residing will in order that your needs are recognized. Assign an influence of lawyer. Arrange a belief if essential. Get incapacity and life insurance coverage to switch your earnings should you die or can’t work. Sure, these items price cash however the fee is a fraction of the difficulty that can ensue if one thing occurs to you and you’re unprepared. Evaluate these items every year to make sure no adjustments are required.

On the finish of those twenty-one days, hopefully you’ve solved a few of your monetary issues and have a plan to take care of the remainder. You’re in your strategy to higher cash administration habits. For those who begin to backslide, assessment these twenty-one days to encourage you to maintain moving into your new, optimistic course.

[ad_2]

Source link