[ad_1]

With increasingly more information tales of bank card theft, folks start to search for methods to guard themselves. One firm that they are going to seemingly come throughout of their search is Lifelock and lots of surprise, “Is Lifelock a rip-off?” The excellent news it that it’s not a rip-off within the literal sense. The unhealthy information is that it most likely doesn’t give you all of the safety that you just suppose it does.

About Lifelock

LifeLock, now referred to as Lifelock by Norton was based in 2005 by Todd David and Robert Maynard. In 2017 LifeLock was acquired by Symantec for $2.3 Billion and later bought to Gen Digital Inc., the place the software program was marketed as a bundle with Norton 360. The product has numerous tiers – with particular person plans providing as much as $1,000,000 protection for authorized experience, $25,000 in theft reimbursement and credit score monitoring protection.

Whereas there are a selection of people that have been pleased with the LifeLock’s companies, there are fairly a number of who’ve complaints about LifeLock’s insurance policies and practices. For instance, LifeLock has a 1.08 score (out of 5) from the Higher Enterprise Bureau, and over 1,324 complaints closed within the final three years (here).

Listed here are a number of causes why you don’t need LifeLock:

Their Assure Doesn’t Shield Towards Direct Losses

Whereas LifeLock pledges to spend $1 million to revive a buyer’s id after they’ve been a sufferer of id theft, that assure doesn’t really defend the shopper towards expenses incurred. Nor does the assure promise to revive the cash that was misplaced.

Overpriced

LifeLock expenses $11.99 a month for his or her companies, which comes out to a complete of $143.88 for the 12 months. When you might imagine that it is a cheap worth to pay to safe your id from being stolen, lots of the companies that LifeLock guarantees are freed from cost elsewhere. Whereas it might take extra of your private time to name up credit score firms to arrange fraud alerts or choose out of bank card affords, it would prevent from paying $12 a month for a 3rd occasion to do the identical factor.

Fraud Alerts

Considered one of LifeLock’s practices is asking credit score bureaus to place free fraud alerts on all of your accounts in order that each you and LifeLock can be notified of any fraudulent exercise. As an alternative of getting LifeLock, a 3rd occasion, ask the credit score bureaus to enact this in your behalf, you’ll be able to place a fraud alert in your info your self. You solely should notify one bureau, as they are going to notify the remaining two of the fraud alerts positioned in your accounts.

Renewing Fraud Alerts

Fraud alerts expire after 90 days, and LifeLock claims that they’ll routinely renew your alerts as soon as the 90 days are up. Whereas it’s simple to have an computerized renewal for the fraud alerts in your accounts, it’s additionally fairly simple to only name up the credit score bureaus and request one other fraud alert. When you’re anxious about forgetting to take action, simply make an observation in your calendar to remind you.

Pre-Authorised Credit score Card Affords

Nearly everybody has skilled receiving tons of spam mail that embrace pre-approved bank card affords. Whereas LifeLock claims that they are going to request that your title be faraway from such unsolicited mail affords, you are able to do this your self. Simply go to optoutprescreen and put in all of your info as a substitute of handing it over to LifeLock.

Credit score Experiences

LifeLock additionally says a part of its companies embrace ordering a free annual credit score report for its customers. Nonetheless, you’ll be able to order a free annual credit score report from annual credit report, which works with the three authorised credit score bureaus, and could possibly get more free credit reports as nicely. It’s far safer to undergo a legit, authorities authorised credit score bureau than a 3rd occasion website.

Sneaky Promoting

Whereas id theft ought to all the time be a trigger for concern, LifeLock’s practices are based mostly extra on the concern of id theft quite than id theft itself. The corporate’s advertising practices need you to consider that there’s a big probability that your id can be stolen and that solely they’ll stop that. Nonetheless, there are several steps you’ll be able to take by yourself to assist stop id theft.

Disputing Fraudulent Expenses

LifeLock additionally claims that whereas it gained’t dispute the fraudulent expenses you obtain, it would enable you cancel your bank cards and call all of your monetary establishments. As an alternative of letting LifeLock enable you contact your financial institution, do it your self. Most monetary establishments will forgive fraudulent expenses should you notify them inside 30 to 60 days. It might take numerous time on the cellphone to exchange every part and get these expenses cleared up, nevertheless it’s higher to have them taken care of fully.

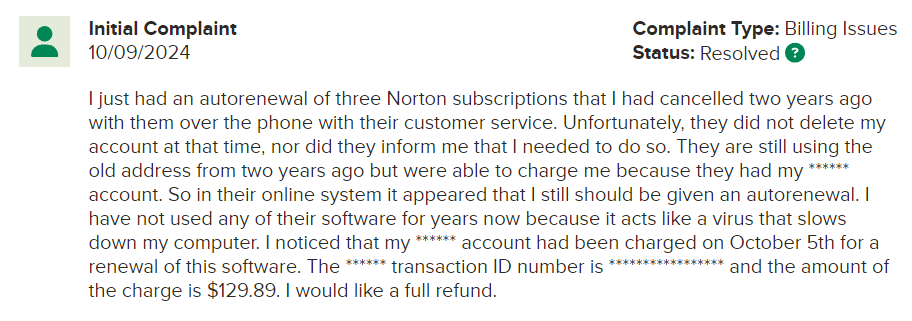

Billing Points

Some people on-line have complained that after cancelling their subscription to LifeLock, the corporate has continued to cost them month-to-month charges. For instance, here’s what one consumer mentioned about their service.

Many third occasion credit score or monetary organizations and companies are sometimes charged with this criticism, so it’s in your greatest curiosity to suppose very rigorously about whether or not or not you wish to take care of the sort of downside.

Third Occasion

One of many largest explanation why you don’t want LifeLock is that, in the long run, it’s a 3rd occasion enterprise who will now have entry to all of your private info. Most individuals know that they shouldn’t give out their social safety quantity to 3rd events, as that’s one of many largest targets for id theft. LifeLock is a fast and simple answer, however you’re much better dealing with id theft prevention your self. There’s no want for a 3rd occasion to have entry to your info or to take steps that you can full your self.

Readers, what has your expertise with LifeLock been? Depart us a remark beneath.

[ad_2]

Source link